The smart Trick of Estate Planning Attorney That Nobody is Talking About

The smart Trick of Estate Planning Attorney That Nobody is Talking About

Blog Article

The Only Guide for Estate Planning Attorney

Table of ContentsWhat Does Estate Planning Attorney Mean?All about Estate Planning AttorneyThe Greatest Guide To Estate Planning AttorneyHow Estate Planning Attorney can Save You Time, Stress, and Money.

Your attorney will likewise assist you make your papers authorities, preparing for witnesses and notary public trademarks as necessary, so you don't have to fret about trying to do that last action on your very own - Estate Planning Attorney. Last, yet not the very least, there is valuable satisfaction in establishing a relationship with an estate planning lawyer that can be there for you later onPut simply, estate planning attorneys give worth in lots of ways, much past simply providing you with published wills, trust funds, or various other estate planning documents. If you have inquiries regarding the process and desire to discover much more, call our workplace today.

An estate planning lawyer assists you formalize end-of-life choices and lawful papers. They can set up wills, develop depends on, create wellness care instructions, develop power of attorney, produce succession strategies, and more, according to your dreams. Working with an estate preparation attorney to finish and oversee this lawful paperwork can aid you in the following 8 areas: Estate intending attorneys are professionals in your state's trust, probate, and tax obligation laws.

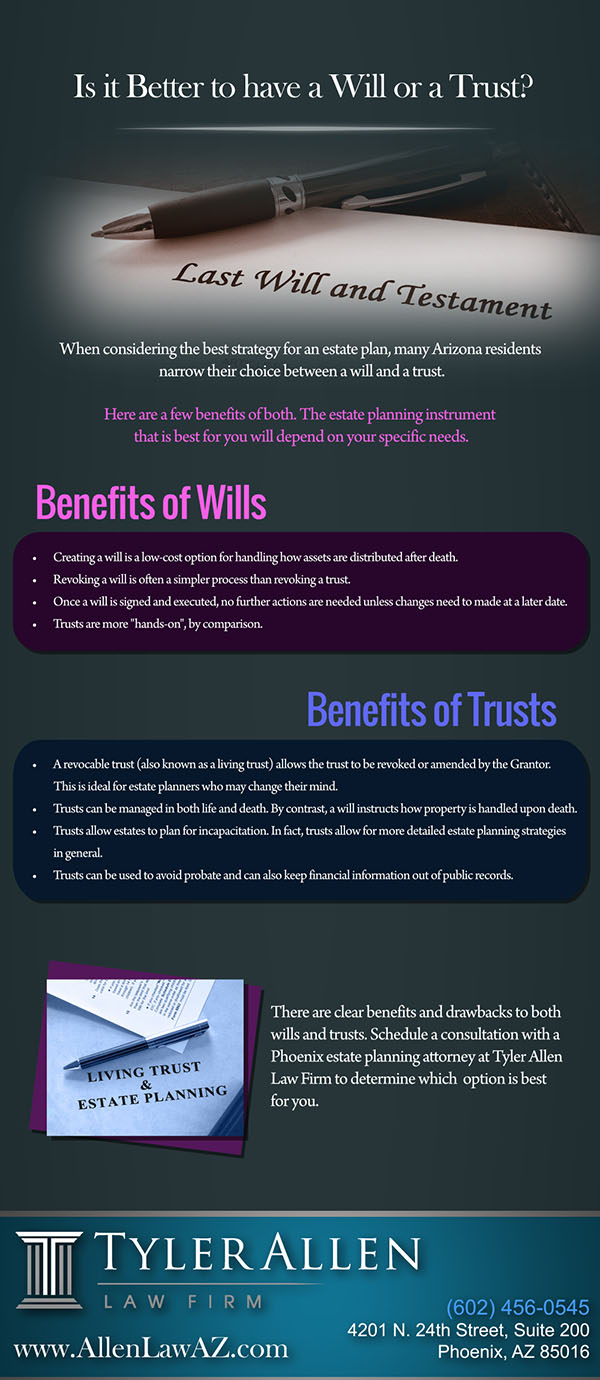

If you don't have a will, the state can decide exactly how to separate your assets among your successors, which might not be according to your desires. An estate planning attorney can help arrange all your legal papers and disperse your assets as you wish, possibly preventing probate.

Everything about Estate Planning Attorney

As soon as a customer dies, an estate strategy would certainly dictate the dispersal of possessions per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these choices might be delegated the near relative or the state. Obligations of estate organizers consist of: Developing a last will and testimony Establishing up depend on accounts Calling an executor and power of attorneys Identifying all beneficiaries Naming a guardian for small youngsters Paying all debts and reducing all taxes and legal costs Crafting guidelines for passing your worths Developing choices for funeral plans Wrapping up guidelines for treatment if you come to be unwell and are unable to choose Acquiring life insurance coverage, special needs earnings insurance coverage, and long-lasting treatment insurance coverage A good estate strategy must be updated on a regular basis as clients' financial scenarios, personal inspirations, and government and state laws all advance

Just like any career, there are attributes pop over to this site and skills that can aid you achieve these objectives as you collaborate with your customers in an estate coordinator duty. An estate planning career can be ideal for you if you possess the following qualities: Being an estate planner suggests believing in the lengthy term.

7 Easy Facts About Estate Planning Attorney Described

You need to assist your customer anticipate his or her end of life and what will happen postmortem, while at the same time not dwelling on morbid ideas or feelings. Some customers might end up being bitter or troubled when considering death and it could drop to you to aid them via it.

In the occasion of death, you may be anticipated to have countless discussions and negotiations with making it through member of the family about the estate strategy. In order to stand out as an estate planner, you may require to stroll a fine line of being a shoulder to lean official statement on and the individual counted on to connect estate preparation matters in a timely and specialist way.

tax obligation code altered hundreds of times in the ten years in between 2001 and 2012. Expect that it has actually been altered better ever since. Depending upon your customer's financial earnings brace, which may advance toward end-of-life, you as this an estate coordinator will certainly have to keep your customer's properties in full lawful conformity with any regional, government, or international tax obligation regulations.

The Only Guide to Estate Planning Attorney

Gaining this accreditation from organizations like the National Institute of Certified Estate Planners, Inc. can be a strong differentiator. Belonging to these specialist teams can verify your skills, making you much more attractive in the eyes of a potential customer. Along with the emotional reward of helping customers with end-of-life preparation, estate planners enjoy the advantages of a steady earnings.

Estate planning is a smart thing to do no matter of your current wellness and financial standing. The very first vital thing is to work with an estate planning lawyer to help you with it.

A skilled lawyer recognizes what information to consist of in the will, including your recipients and special considerations. It likewise gives the swiftest and most effective technique to move your properties to your beneficiaries.

Report this page